The annual entitlement is usually divided by 12 and issued monthly as part of the ontario trillium benefit otb payment see first three bullets of the note below for exceptions.

Energy efficiency tax credit canada.

The energy savings rebate program makes energy efficient products more accessible to people across ontario.

This credit is worth a maximum of 500 for all years combined from 2006 to its expiration.

30 for property placed in service after december 31 2016 and before january 1 2020.

The tax credits for residential renewable energy products are still available through december 31 2021.

The tax credit for builders of energy efficient homes and tax deductions for energy efficient commercial buildings have also been retroactively extended through december 31 2020.

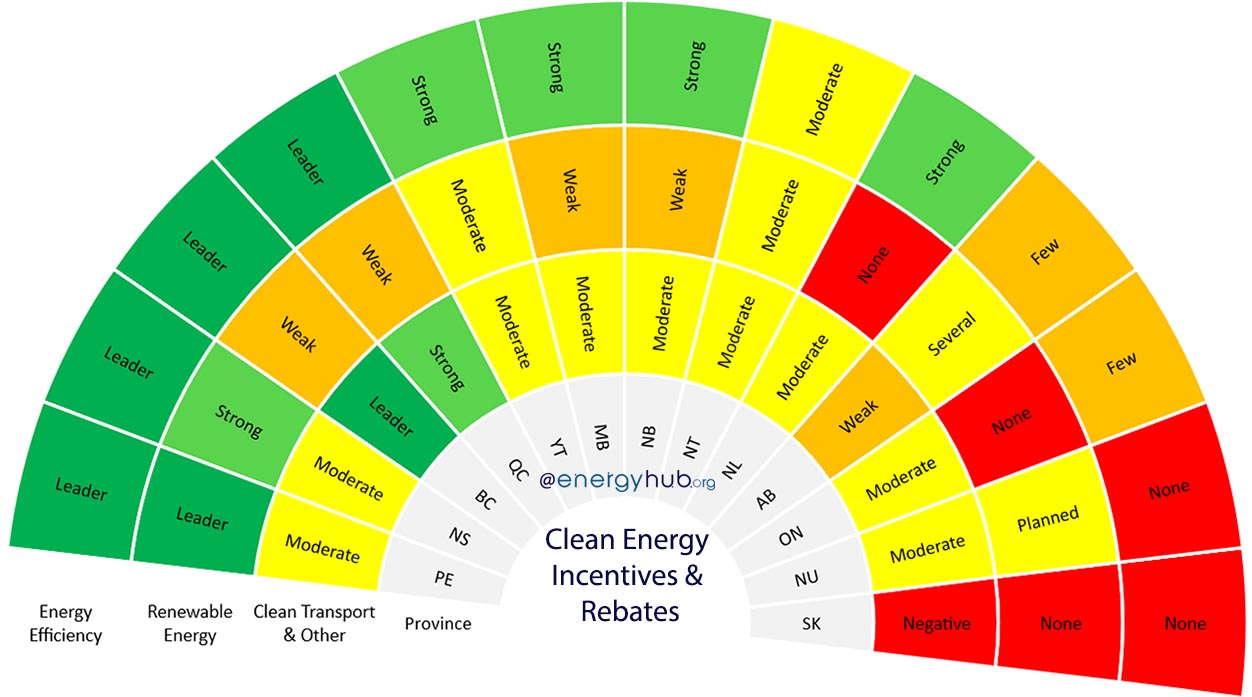

A grouping of incentives related to energy efficiency from provincial territorial governments major canadian municipalities and major electric and gas.

Carefully planned renovations not only make your home more comfortable but they can increase its value too.

Of that combined 500 limit a maximum of 200 can be for windows.

Of course renovations can be expensive but did you know that there are all kinds of programs that will help foot the bill.

Here are some of the best tax benefits rebates and grants you can get for renovating in canada.

The program provides 200 million over two years to participating retailers big and small to help ontario residents afford energy efficient products.

Renovating your home is one of the wisest investments you can make.

Qualified improvements include adding insulation energy efficient exterior windows and doors and certain roofs.

Renewable energy tax credits for fuel cells small wind turbines and geothermal heat pumps now feature a gradual step down in the credit value the same as those for solar energy systems.

Energy efficiency for homes.

To verify tax credit eligibility ask your hvac contractor to provide the manufacturer certification statement for the equipment you plan to purchase.

Select your province to see what financial incentives or programs are available.

Central air conditioning cac air conditioners recognized as energy star most efficient meet the requirements for this tax credit.

You can claim a tax credit for 10 of the cost of qualified energy efficiency improvements and 100 of residential energy property costs.

Part of this credit is worth 10 percent of the cost of certain qualified energy saving items added to a taxpayer s main home last year.

Do not include the cost to install these items.

26 for property placed in service after december 31 2019 and before january 1 2021.

However the agency updates its website annually to reflect changes in credits and benefits and posts a comprehensive list of provincial and territorial government agencies who do provide rebates to homeowners.

Financial incentives by province.