A master limited partnership mlp is a business venture that exists in the form of a publicly traded limited partnership.

Energy infrastructure master limited partnerships.

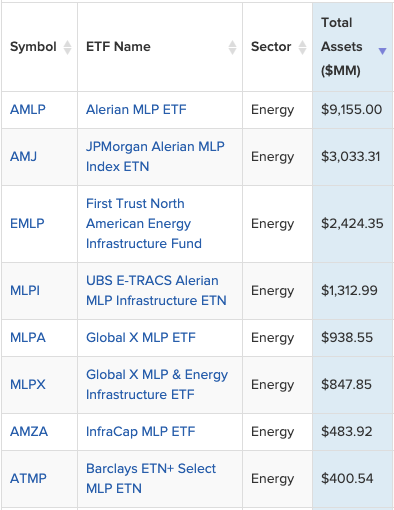

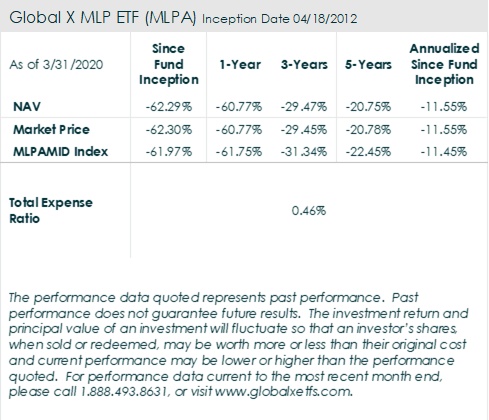

The capped float adjusted capitalization weighted index whose constituents earn the majority of their cash flow from midstream activities involving energy commodities is disseminated real time on a price return basis amz and on a total return basis amzx.

Let s look at the stock market s largest master limited partnerships.

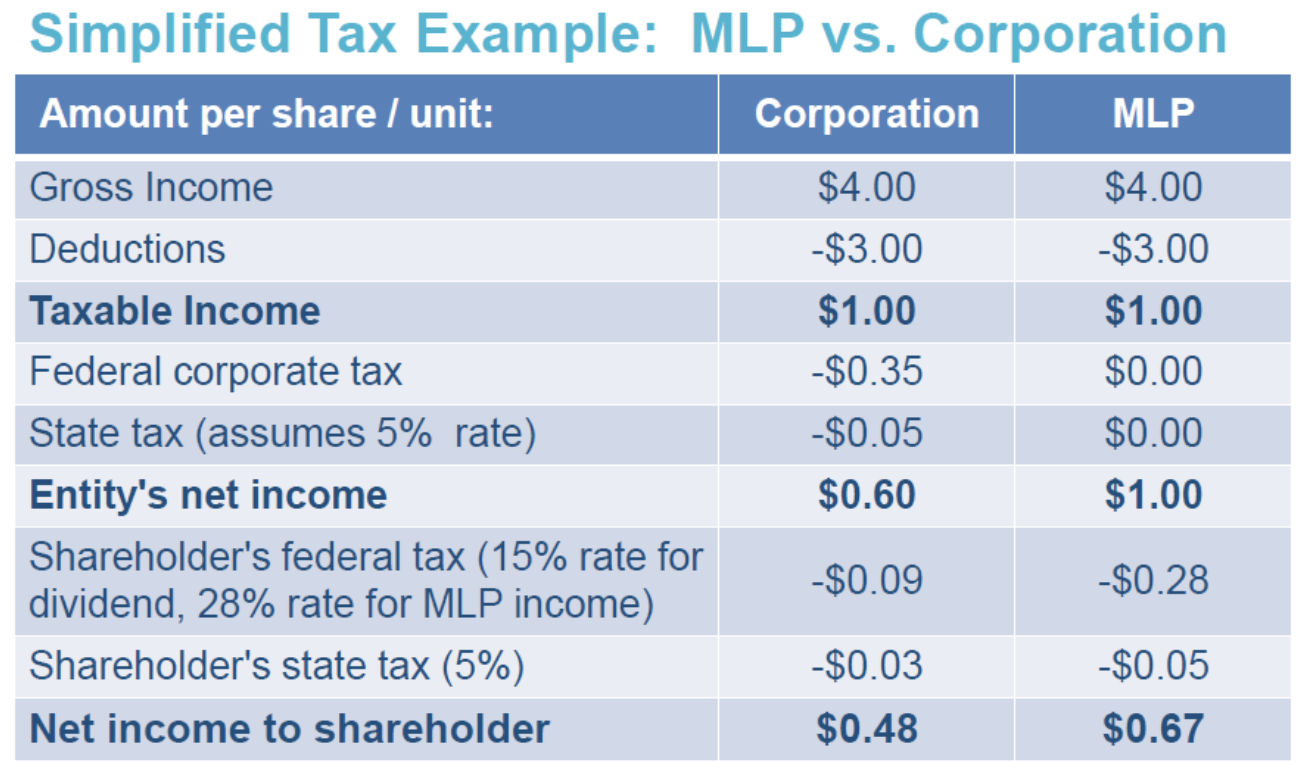

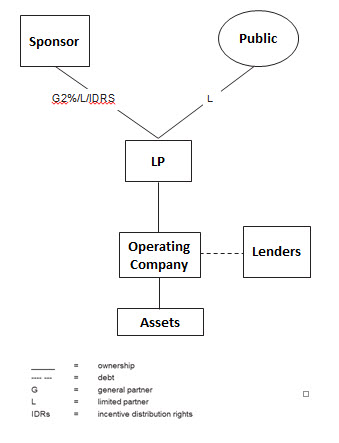

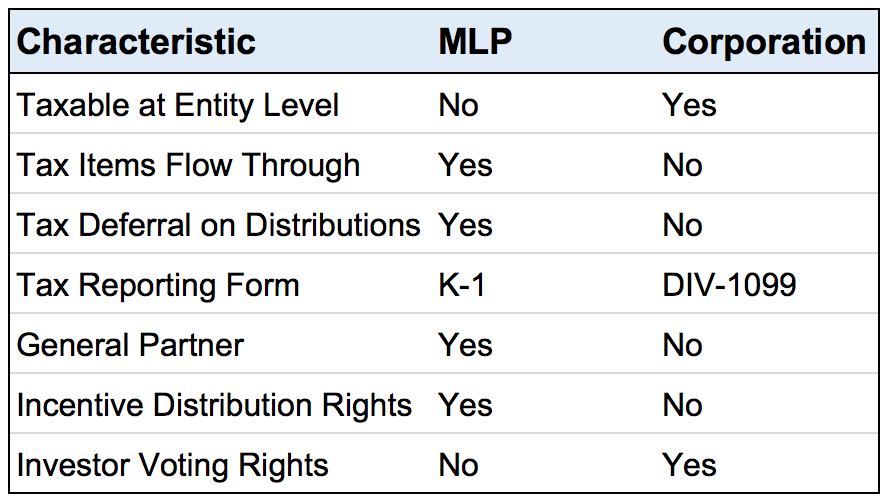

In the united states a master limited partnership mlp or publicly traded partnership ptp is a publicly traded entity taxed as a partnership it combines the tax benefits of a partnership with the liquidity of publicly traded securities.

Ziebart its president and ceo who in consultation with the eic board leads and manages eic s operations and outreach activities with policymakers the investment community and the public to communicate the significant value energy infrastructure companies and master limited partnerships mlps contribute to.

Its assets have total gathering capacity of nearly 13 million btu day of gas and a transportation capacity of 22 million btu day of natural gas and over 4 million barrels per day of oil.

The eic is managed by lori e.

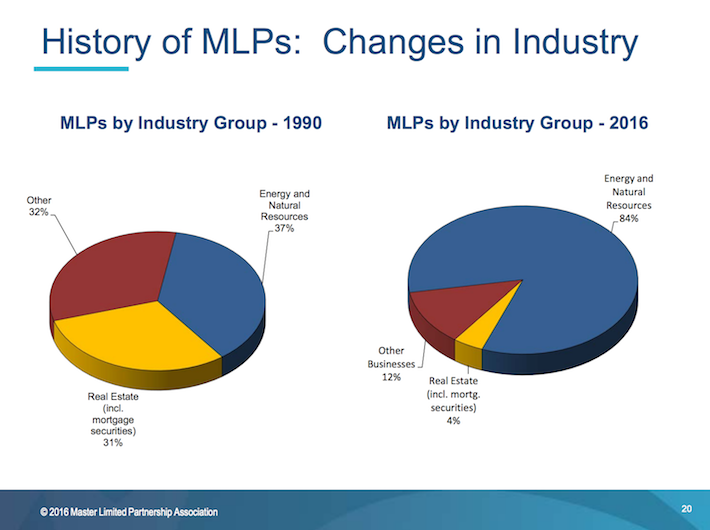

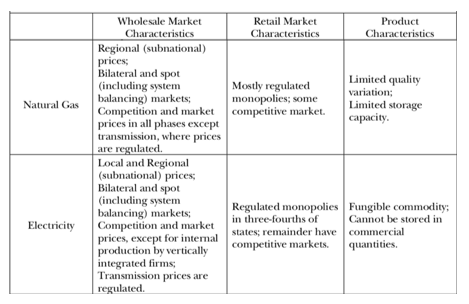

Energy master limited partnerships engage in the transportation treating processing refining storage marketing exploration and production of natural resources.

Cheniere energy partners nysemkt cqp 37 1 billion.

The alerian mlp index is the leading gauge of energy infrastructure master limited partnerships mlps.

The structure narrowly defined by congress in 1987 enables qualifying businesses to raise capital from a broad base of investors by utilizing.

Energy master limited partnerships engage in the transportation treating processing refining storage marketing exploration and production of natural resources.

Energy transfer s business model is storage and transportation of oil and gas.

Mlps are asset heavy capital.

Energy transfer is a midstream oil and gas master limited partnership or mlp.

To obtain the tax benefits of a pass through mlps must generate at least 90 or more of their income from qualifying sources such as from production.

Energy transportation data and utility infrastructure.